Mortgage Applications Increase Marginally in December

January 8, 2025

- Ginnie Mae executive Leslie Meaux Pordzik announces retirement

- Institutional shareholders may be less affected by Federal Agricultural Mortgage Corporation’s (NYSE:AGM) pullback last week after a year of 5.2% returns

- What This Means for Buyers and Sellers

- US mortgage market in 2025 – will it turn the corner?

- JPMorgan, Bank of America offer mortgage relief for victims of LA wildfires

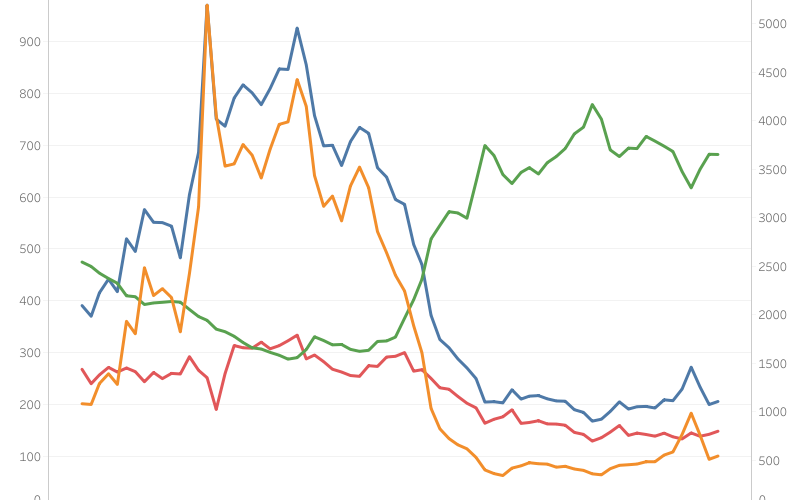

The Market Composite Index, a measure of mortgage loan application volume from the Mortgage Bankers Association’s (MBA) weekly survey, increase marginally by 2.9% month-over-month on a seasonally adjusted (SA) basis. Compared to December 2023, the index is higher by 10.2%. The Market Composite Index includes the Purchase and Refinance Indices, which saw monthly gains of 4.1% and 6.7% (SA), respectively. On a year-over-year basis, the Purchase Index showed a modest increase of 1.1%, while the Refinance Index is 31.7% higher.

Bạn đang xem: Mortgage Applications Increase Marginally in December

The average 30-year fixed rate mortgage reported in the MBA survey for December remained relatively stable at 6.82% (index level 682), reflecting a minor decline of 0.4 basis points. This rate is 9 basis points lower than the same period last year.

Xem thêm : Mortgage Rates Hit 6.91%, Highest Since July, But Buyers Return Despite Costs

Average loan sizes, excluding refinance loans, saw slight declines in December. On a non-seasonally adjusted (NSA) basis, the average loan size (purchases and refinances combined) fell by 2.1% from November to $370,300. For purchase loans, the average size decreased by 3.3% to $421,800, while refinance loans experienced a 4.8% increase, reaching an average of $304,500. Adjustable-rate mortgages (ARMs) also saw a marginal decline in loan size, down 0.8% from $1.08 million to $1.07 million.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

Nguồn: https://modusoperandi.my

Danh mục: News