January 8, 2025

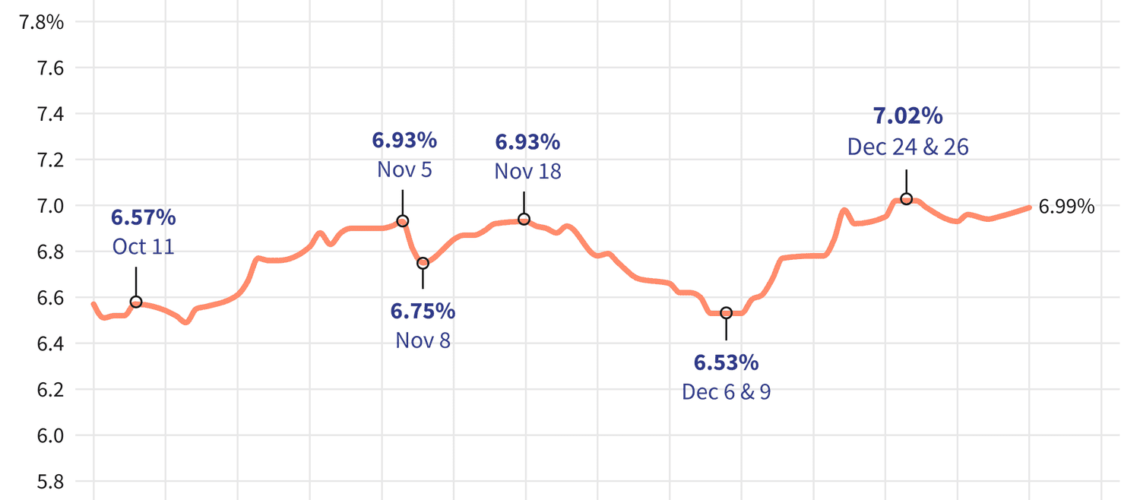

Consumer sentiment was relatively high in December, largely driven by expectations of declining mortgage rates in 2025. Last year at this time, consumers were feeling much better about the housing market compared to a year earlier. But as 2024 progressed,… Continue Reading…