January 8, 2025

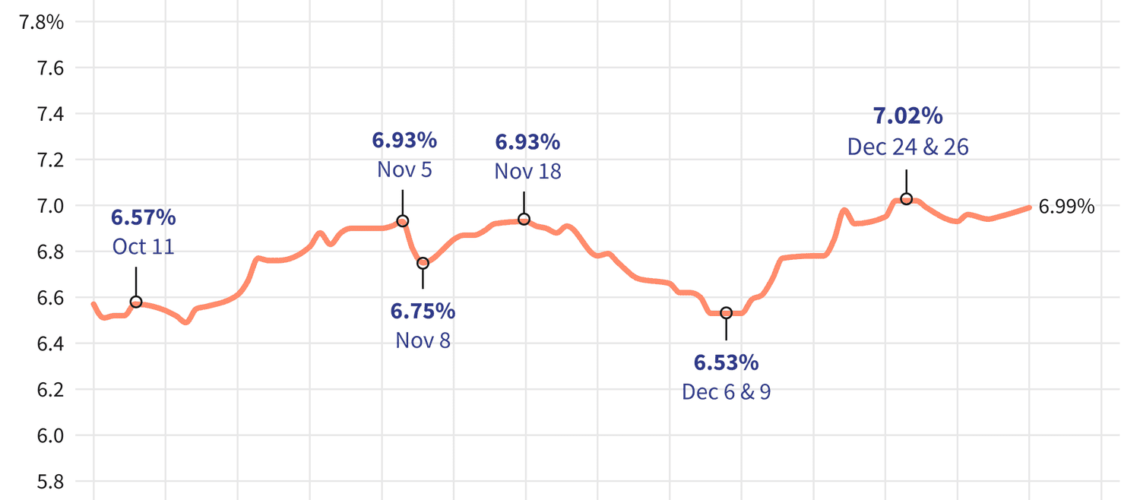

As mortgage rates surge, securing a lower rate may seem out of reach—especially in the 5 percent range. Fortunately, there are a few options for homebuyers looking to eke out a favorable rate. Why It Matters The average rate for… Continue Reading…