Mortgage Applications Decreased in Weekly Survey

December 18, 2024

by Calculated Risk on 12/18/2024 07:00:00 AM

Bạn đang xem: Mortgage Applications Decreased in Weekly Survey

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 0.7 percent from

one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage

Applications Survey for the week ending December 13, 2024.The Market Composite Index, a measure of mortgage loan application volume, decreased 0.7 percent on

a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 2

percent compared with the previous week. The Refinance Index decreased 3 percent from the previous

week and was 41 percent higher than the same week one year ago. The seasonally adjusted Purchase

Index increased 1 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent

compared with the previous week and was 6 percent higher than the same week one year ago.“Mortgage rates increased last week, leading to overall mortgage application activity decreasing for the

first time in five weeks, said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Conventional

and VA purchase applications drove this week’s increase in purchase activity on a weekly and annual

basis. Buyers remained active in the purchase market, helped by gradually improving inventory

conditions and a more positive outlook on the economy and job market. Refinance applications declined

last week, largely driven by VA refinances that were down 17 percent after two weeks of gains.”

…

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances

($766,550 or less) increased to 6.75 percent from 6.67 percent, with points remaining unchanged at 0.66

(including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Xem thêm : Fannie, Freddie release likely. It’s just a matter of when

Click on graph for larger image.

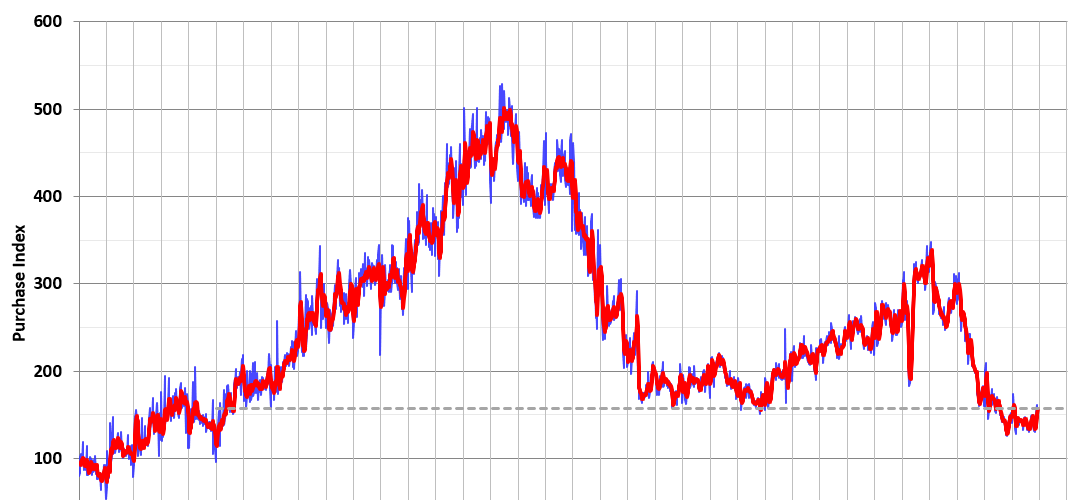

The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is up 6% year-over-year unadjusted.

Xem thêm : Today’s Mortgage Rates Rise Averaging 7.01%: January 01, 2025

Red is a four-week average (blue is weekly).

Purchase application activity is up about 25% from the lows in late October 2023 and is now 4% above the lowest levels during the housing bust.

The refinance index increased as mortgage rates declined in September, but the index declined as rates moved back up.

Nguồn: https://modusoperandi.my

Danh mục: News