Mortgage Applications Decreased in Weekly Survey

January 8, 2025

by Calculated Risk on 1/08/2025 07:00:00 AM

Bạn đang xem: Mortgage Applications Decreased in Weekly Survey

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 3.7 percent from one

week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage

Applications Survey for the week ending January 3, 2025. This week’s results include an adjustment for

the New Year’s holiday.The Market Composite Index, a measure of mortgage loan application volume, decreased 3.7 percent on

a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 47

percent compared with the previous week. The Refinance Index increased 2 percent from the previous

week and was 6 percent lower than the same week one year ago. The seasonally adjusted Purchase

Index decreased 7 percent from one week earlier. The unadjusted Purchase Index increased 43 percent

compared with the previous week and was 15 percent lower than the same week one year ago.“Applications decreased last week as rising mortgage rates continued to discourage buyers from entering

the market and put a damper on purchase activity. The 30-year fixed rate increased for the fourth

consecutive week, reaching 6.99 percent – the highest rate since July 2024,” said Joel Kan, MBA’s Vice

President and Deputy Chief Economist. “Purchase applications declined for both conventional and

government loans and dropped to the slowest weekly pace since February 2024. Refinance applications

increased despite higher rates, but the increase was compared to recent low levels and was entirely

driven by an increase in VA refinances, which continue to show weekly swings.”

…

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances

($766,550 or less) increased to 6.99 percent from 6.97 percent, with points decreasing to 0.68 from 0.72

(including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The effective rate remained

unchanged from last week.

emphasis added

Xem thêm : The Fed Has Lowered Rates Again. Does That Mean 2025 Mortgage Rates Will Fall?

Click on graph for larger image.

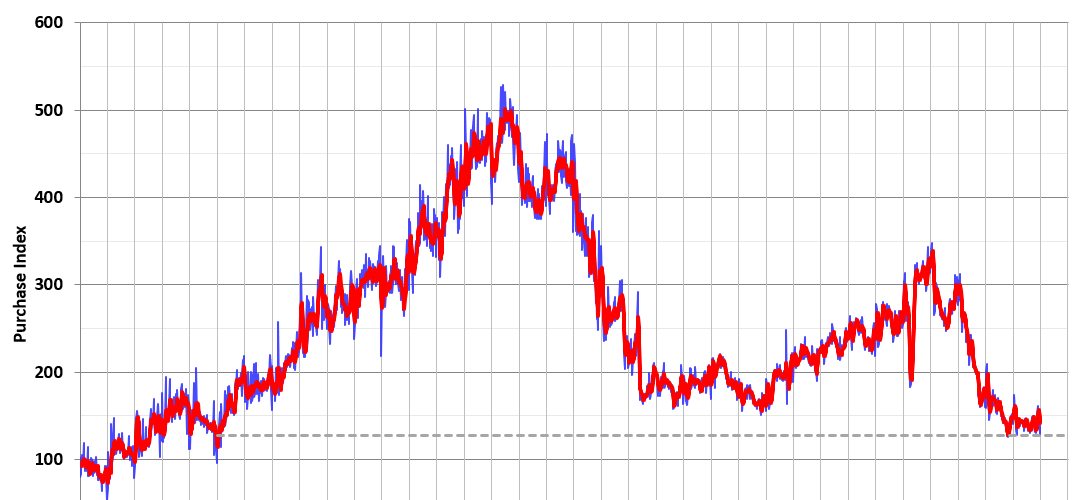

The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 15% year-over-year unadjusted.

Xem thêm : Mortgage Rate Predictions for the End of 2024: What Comes Next?

Red is a four-week average (blue is weekly).

Purchase application activity is up about 2% from the lows in late October 2023 and is now 15% below the lowest levels during the housing bust.

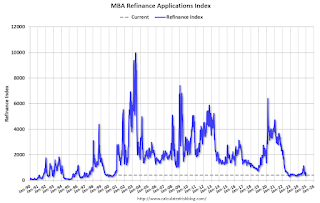

The refinance index is very low.

Nguồn: https://modusoperandi.my

Danh mục: News