January 13, 2025

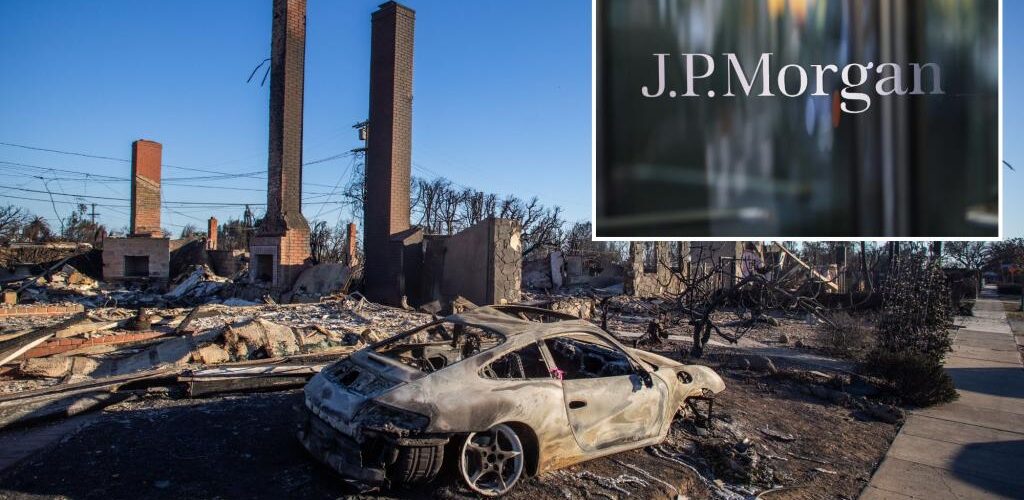

The fires in Los Angeles County are ongoing with strong winds expected throughout Monday, Tuesday and into Wednesday. County officials say 24 people have died and early estimates of the economic costs have reached as high as $150 billion. The… Continue Reading…