December 31, 2024

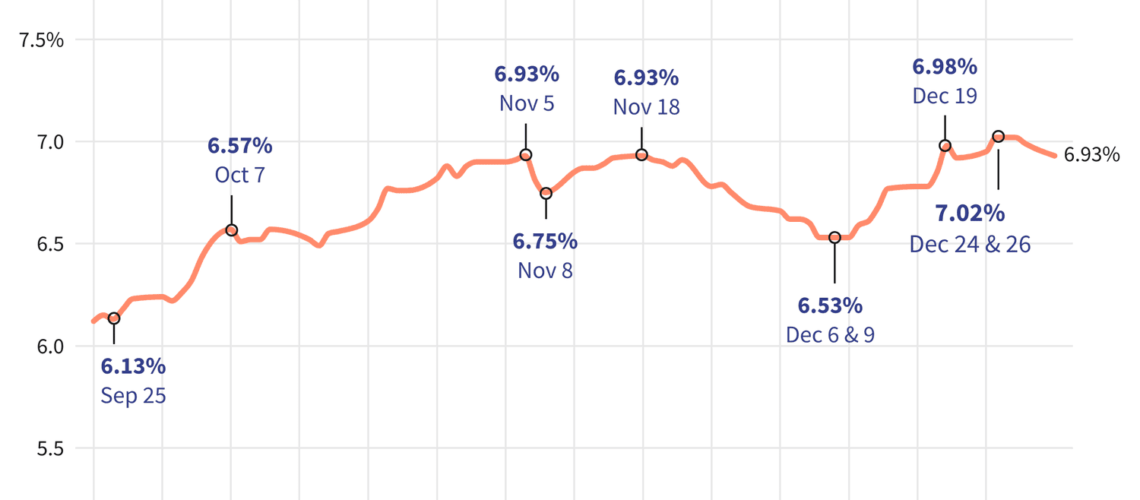

National Averages of Lenders’ Best Rates – New Purchase Loan Type New Purchase Rates Daily Change 30-Year Fixed 6.93% -0.06 FHA 30-Year Fixed 6.28% No Change VA 30-Year Fixed 6.45% -0.09 20-Year Fixed 6.84% -0.09 15-Year Fixed 6.18% -0.08 FHA… Continue Reading…